December 2024 marks a critical time for Canadian seniors as they receive their Old Age Security (OAS) and Canada Pension Plan (CPP) payments.

These benefits are vital for financial security, offering monthly support to retirees, individuals with disabilities, and survivors.

Let’s unpack the eligibility criteria, payment dates, and application processes to help you navigate these essential programs effectively.

$600 OAS and CPP Payments

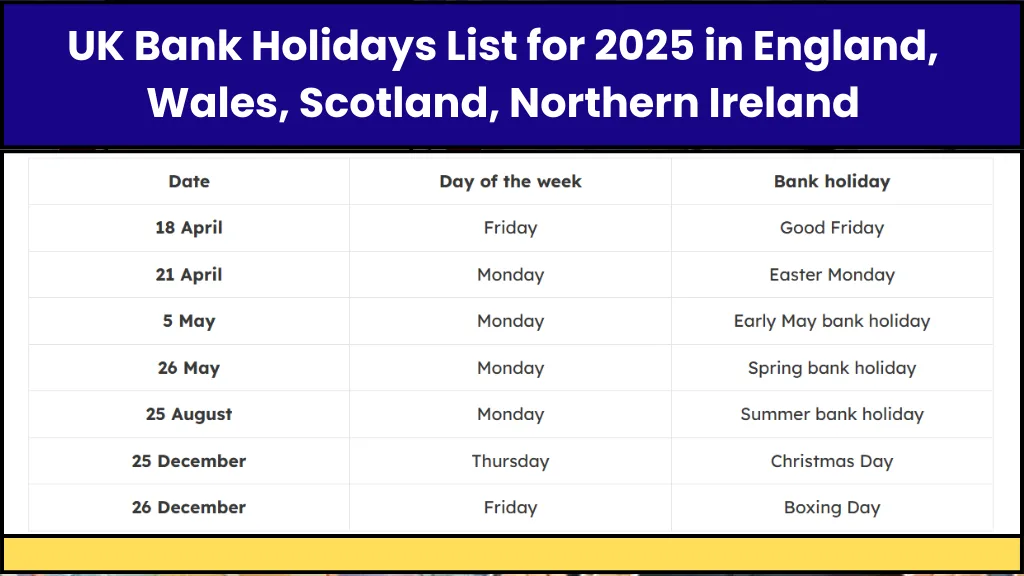

| Topic | Details |

|---|---|

| OAS Eligibility | Canadians aged 65+, with at least 10 years of residency |

| CPP Eligibility | Based on work history and contributions; start as early as 60 |

| Payment Date | December 30, 2024 |

| Payment Amounts | Average: $1,200 monthly for OAS and CPP each |

| Clawback Thresholds | Starts at $81,761 (single) or $130,107 (couples) |

| Application Timing | Apply at least 6 months before benefits are needed |

What Is OAS?

Old Age Security Overview

Old Age Security (OAS) is a universal benefit provided to Canadians aged 65 or older. Unlike CPP, OAS payments are not based on contributions but on residency.

This makes it accessible to many Canadians, even those who didn’t work extensively or contribute to the CPP.

OAS Eligibility

To qualify for OAS in December 2024, you must:

- Be 65 or Older: Payments begin at the end of the month you turn 65.

- Meet Residency Requirements: Have lived in Canada for at least 10 years after age 18. Full OAS benefits require 40 years of residency, with prorated amounts for shorter stays.

OAS Clawback

If your income exceeds certain thresholds, OAS benefits are reduced:

- $81,761 for single individuals

- $130,107 for couples

The clawback reduces OAS by 15% of income above these thresholds and may eliminate benefits entirely for high earners.

What Is CPP?

Canada Pension Plan Overview

The Canada Pension Plan (CPP) is a contributory program that provides monthly payments to Canadians based on their work history and contributions.

CPP is more flexible than OAS, with payments starting as early as age 60 (at a reduced rate) or as late as age 70 (at an enhanced rate).

CPP Eligibility

You must meet the following criteria to receive CPP:

- Age: Start receiving payments as early as 60, with full benefits available at 65.

- Contributions: You need to have contributed to CPP through employment or self-employment during your working years.

CPP Payment Amounts

The average monthly CPP payment in 2024 is approximately $1,200 at age 65, with higher payments for those delaying benefits past this age.

Payment Dates for December 2024

Both OAS and CPP payments are issued on the third-to-last business day of each month.

For December 2024, the payment date is expected to be Monday, December 30th.

- Direct Deposit: Payments are automatically deposited into your bank account for faster access.

- Paper Cheques: If you haven’t set up direct deposit, cheques will be mailed, potentially causing delays.

How to Apply

Applying for OAS

- When to Apply: Submit your application at least 6 months before turning 65.

- Where to Apply: Apply online through My Service Canada Account, by mail, or in person at a Service Canada office.

- Documents Needed: Provide your Social Insurance Number (SIN) and proof of residency.

Applying for CPP

- When to Apply: Apply 6 months before you want to start receiving benefits.

- Where to Apply: Use the same methods as for OAS—online, by mail, or in person.

- Documents Needed: Include your SIN, proof of contributions, and banking details for direct deposit.

Tax Considerations

OAS and CPP payments are taxable and must be reported on your income tax return.

These benefits may increase your taxable income, potentially affecting your tax rate or eligibility for other programs.

If your income is high, consult a tax professional to minimize liabilities and optimize tax credits.

Additional Resources

If you don’t qualify for OAS or CPP, consider these alternatives:

- Guaranteed Income Supplement (GIS): Available to low-income seniors receiving OAS.

- Provincial Programs: Benefits like Ontario’s GAINS or Alberta Seniors Benefit can provide supplemental financial assistance.

- Financial Planning: Seek advice from financial advisors or Service Canada to explore other retirement income options.

Final Tips

To ensure smooth payment of your OAS and CPP benefits:

- Apply early—six months before you turn 65.

- Update your information with Service Canada, especially for direct deposit.

- Track payment dates and verify amounts through your My Service Canada Account.