South African homeowners may soon benefit from reduced mortgage payments, saving up to R1,400 monthly as the South African Reserve Bank (SARB) is expected to cut interest rates.

This relief can provide much-needed financial stability in a challenging economy.

Let’s explore who qualifies, how the savings work, and actionable steps to make the most of this opportunity.

R1,400 Monthly Savings For South Africans

The SARB’s anticipated interest rate cuts aim to ease financial pressure on homeowners, offering significant savings on home loans. Here’s a quick breakdown:

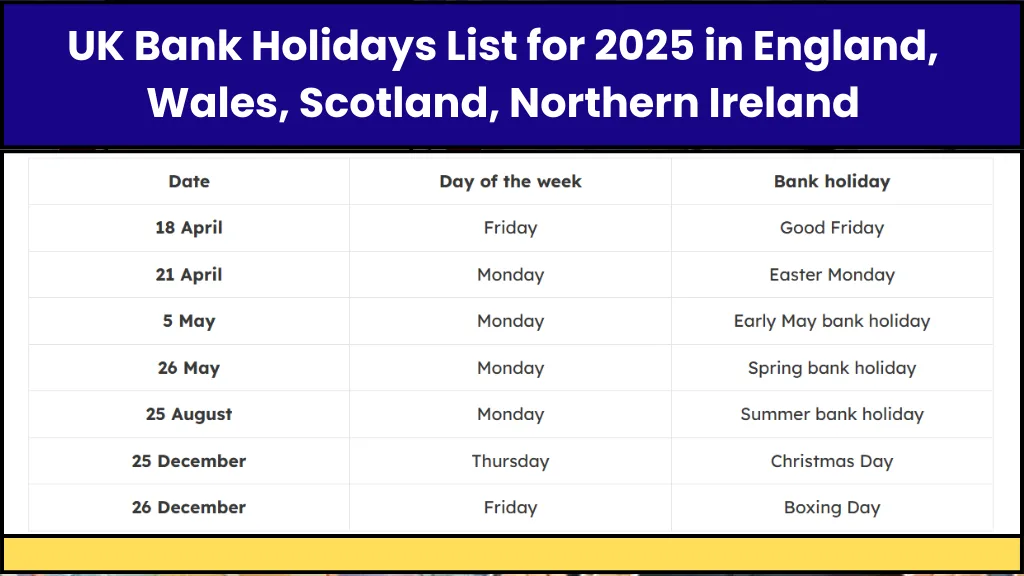

| Key Detail | Description |

|---|---|

| Relief Amount | Up to R1,400 monthly savings on mortgage repayments |

| Eligibility | Active home loan holders residing in South Africa |

| Interest Rate Cut | Up to 1.5% (150 basis points) by mid-2025 |

| Action Required | Automatic adjustment by banks; confirm with lender |

| Documents Needed | Bank statements, proof of income, valid SA ID |

Why This Matters

Lower interest rates mean more disposable income, allowing homeowners to reduce financial stress, invest in future goals, or pay off other debts.

For new buyers, the rate cuts may make homeownership more affordable.

How Interest Rate Cuts Affect Mortgage Payments

The Mechanism

Interest rate cuts by SARB lower the cost of borrowing, which directly impacts home loan repayments.

Banks adjust the interest charged on mortgages, reducing monthly payments.

Example of Savings

Here’s how much you might save depending on your loan size:

| Loan Amount | Current Interest (10.5%) | New Interest (9.0%) | Monthly Savings |

|---|---|---|---|

| R1,000,000 | R9,650 | R8,250 | R1,400 |

| R750,000 | R7,238 | R6,188 | R1,050 |

| R500,000 | R4,825 | R4,125 | R700 |

Use an online loan calculator from major banks like Nedbank or ABSA to estimate your exact savings.

Who Qualifies for the R1,400 Relief?

1. Active Mortgage Holders

Only those with an active home loan qualify. Personal loans, car loans, or credit card debt are excluded.

2. South African Residents

Proof of residency, such as a valid ID or passport, is required.

3. Consistent Payment History

Banks may hesitate to pass full savings to borrowers with a history of missed payments or defaults. Maintaining a strong repayment record ensures you benefit fully.

Steps to Maximize Your Savings

Step 1: Contact Your Bank

Most banks will adjust repayments automatically. However, it’s essential to confirm the new rate and payment schedule with your lender.

Step 2: Review Loan Terms

If you’re on a fixed-rate mortgage, consider renegotiating to take advantage of lower rates.

Step 3: Budget the Savings

Decide how to use the extra R1,400 wisely. Options include:

- Paying Down Debt: Reduce high-interest debt like credit cards.

- Building an Emergency Fund: Save for unexpected expenses.

- Investing: Allocate towards retirement or educational goals.

Step 4: Stay Informed

Monitor SARB announcements and updates from your bank to ensure you’re aware of all changes.

Hidden Opportunities

Beyond reduced repayments, interest rate cuts offer additional benefits:

1. Refinance Your Mortgage

If your loan terms are unfavorable, refinancing at a lower rate could provide even more savings.

2. Accelerated Debt Repayment

Apply the savings toward your principal loan amount. This reduces the overall interest paid and shortens your loan term.

3. Increased Affordability for Buyers

Lower interest rates make buying a home more accessible. If you’re considering entering the property market, now might be the ideal time.

Risks and Challenges

Fixed-Rate Mortgages

If your loan has a fixed interest rate, you may not benefit unless you renegotiate terms with your lender.

Inflation Concerns

While interest rate cuts provide short-term relief, they could contribute to inflation, affecting the broader economy.

Overborrowing

Avoid taking on excessive debt just because borrowing becomes cheaper. Stick to a disciplined financial plan.

Practical Tips for Homeowners

Set Clear Goals

Decide how to use your extra funds:

- Build long-term savings.

- Pay off high-interest debts.

- Invest in property or education.

Avoid Lifestyle Inflation

Don’t spend the additional savings on unnecessary expenses. Keep your focus on financial stability.

Monitor Economic Trends

Stay updated on SARB decisions, inflation rates, and housing market trends to make informed financial choices.

The R1,400 monthly savings for South African homeowners presents a valuable opportunity to strengthen financial health.

By understanding eligibility, staying proactive with your lender, and planning wisely, you can maximize this relief to achieve your financial goals.

Whether paying off debt, building an emergency fund, or investing, this is your chance to create lasting financial stability.